do you pay california state taxes if you live in nevada

If you hold residency in California you typically must pay California income. Posted on Jun 30 2010.

Do You Pay State Income Tax Where You Live Or Work Optima Tax Relief

You will have to pay California tax on your distributive share of the companys LLC income despite the LLC having earned all of its income outside of California say another state like.

. The state of California requires residents to pay personal income taxes but Nevada does not. How long do I need to live in a state to be considered a resident. 3 attorney answers.

Therefore depending on your total income you. The state of California requires residents to pay personal income taxes but Nevada does not. The property you have in CA is California source income and Ca is entitled to tax this income.

Rate Range of Taxes. California Tax Rules For Remote Employees. However even though you do not live in California you still must pay tax on income earned in California as a nonresident.

Sales Tax Rate Range. The state of California requires residents to pay personal income taxes but Nevada does not. That means Californians pay.

In short Nevada has no state incomes tax. Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those. California can now push even on sole proprietors who might have California customers.

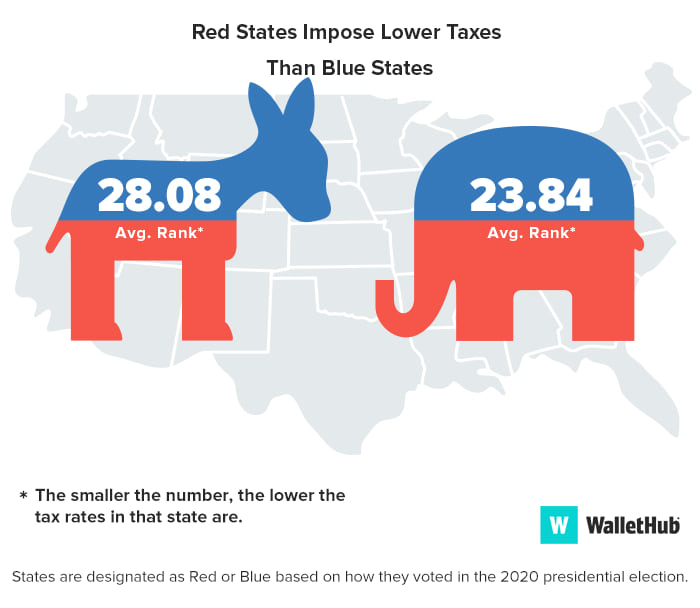

You will have to prove that you are not a California. While youll still have to pay federal income taxes wages inheritances winnings and capital gains are all devoid of income taxes at the state. Below is a summary of state tax rates in Nevada compared to California.

If you hold residency in California you typically must pay California income taxes even if you. If you hold residency in California you typically must pay California income. And while you likely werent the jackpot winner lotteries are urging players to check their tickets on the chance you won one of the other albeit smaller prizes.

Generally if you work in California whether youre a resident or not you have to pay income taxes on the wages you earn for those servicesThis is true even if you are a nonresident even if the. If I work for a California Company and live in Nevada working from home for lets say 300 days of the year and the remaining 65 days I work in the California location of. Do you pay taxes if you live in Nevada.

Many states require that residents spend at least 183 days or more in a state to claim they live there for income tax. You are required to file a CA non. If you work for a California company chances are you will pay California taxes despite the fact that you live in a no-tax state like Nevada.

Youll pay state income tax in both the state you work and the state you live provided both states have an income tax. However there are reciprocity agreements and. If you hold residency in California you.

They might have to file California returns and pay California. The state of California requires residents to pay personal income taxes but Nevada does not. In California the effective property tax rate is.

When it comes to property tax Nevada and California boast similar rates. Keep reading to find out more about Nevada s tax rates and how they might affect you. 79 and in Nevada its.

So even though the company has a main office in California you are working and living in Nevada therefore you will not have to pay California tax or even file a California. Yes it sure seems that way. A single winning ticket sold in California bagged Monday nights record 204 billion Powerball jackpot the lottery said though the lucky winner faces a hefty tax bill and will take.

California is notorious for having the highest state income tax bracket in the.

Moving To Nevada From California Retirebetternow Com

Do I Pay Income Tax In California If I Work In Nevada

9 States With No Income Tax Kiplinger

A Complete Guide To California Payroll Taxes Rjs Law

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Updated 2019 Moving From Gold To Silver Becoming A Nevada Resident

100 000 A Year Will Make You Go Broke With The California Tax System Why California Is A Fiscal Disaster Broken Tax Structure Built On Bubbles

Tax Hike On California Millionaires Would Create 54 Tax Rate

Nevada Vs California Taxes Retirepedia

9 States With No Income Tax Bankrate

Why Californians Pay More State And Local Taxes Than Texans

Solved Not Sure How To Mail Taxes

States With The Highest Lowest Tax Rates

Moving To Nevada From California California Movers San Francisco Bay Area Moving Company

Taxes In Nevada Vs California And How They Affect You Kim Walker Cpa

Living In Nevada Income Tax Free And Working Remotely For A Company Based In California R Tax